publishing

2022-06-13 09:52

Modernization

2022-06-13 15:38

Monday began with the selling of Polish assets, and also continued into the second part of the day. The euro exchange rate rose to its highest level in three weeks. The yields on Polish treasury bonds also rose significantly, which means that the prices of these securities have fallen.

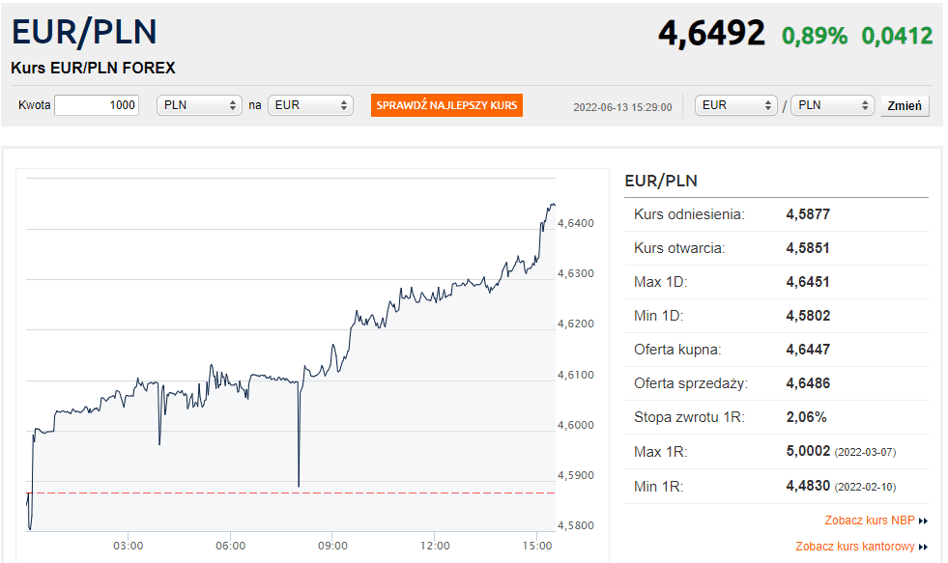

[Aktualizacja 15:30] The heavy selling of the Polish currency intensified in the second half of the day. Just in just over 5 hours of trading, the Euro rose by about 2.5 and was valued at 4.65 PLN.

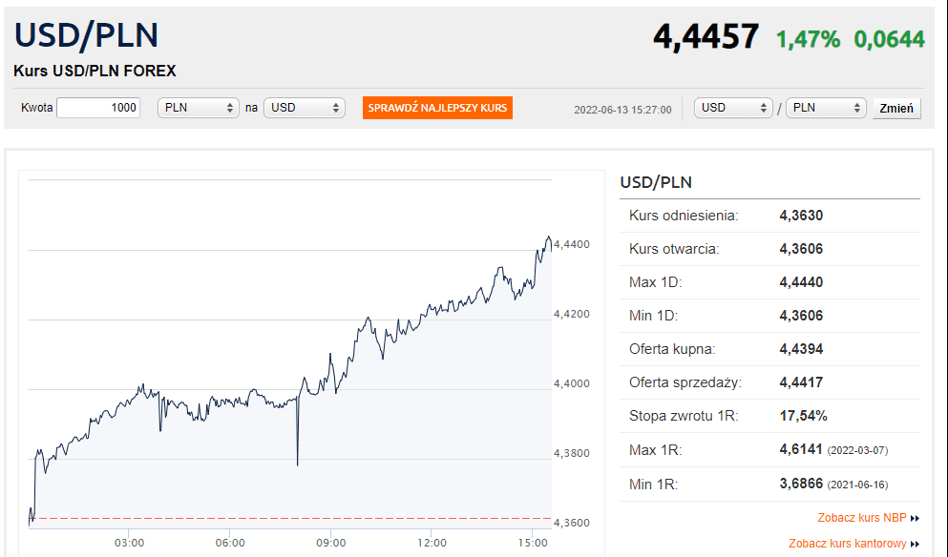

The appreciation of the dollar was even more, which at the same time gained more than 3.5 groszy, which pushed the price of the US currency to the level of PLN 4.447.

The exchange rate of the Swiss franc rose to the level of 4,479 PLN and began approaching its highest levels in June.

Selling the Polish currency is not helping the WSE indices, as the WIG20 was losing 2.6% at 15.30. – as well as the broad WIG.

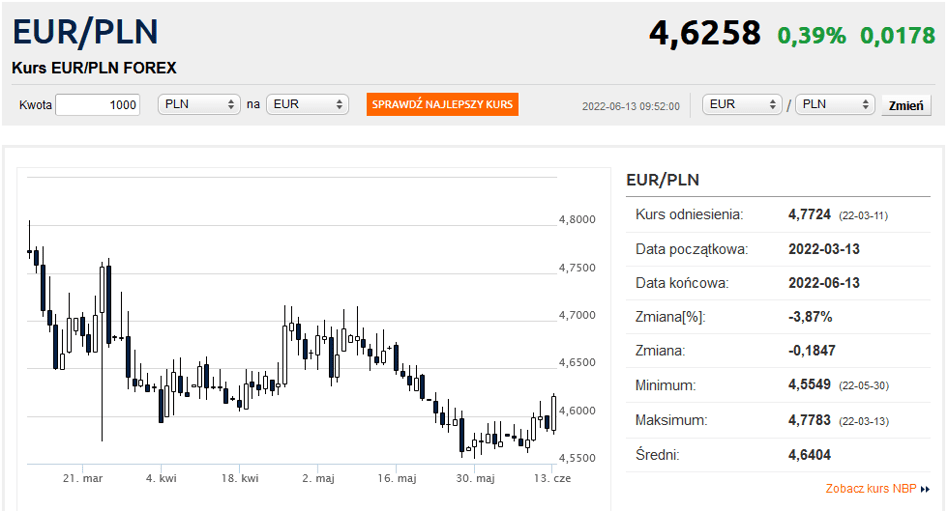

At 9:52, the euro exchange rate rose by more than a penny, reaching the level of 4.6258 Polish zloty – the highest level since May 23. The zloty is already starting to weaken on Thursday After NBP Governor Adam Glapinski suggested that an interest rate hike cycle should be close. Another MPC member argued with that narrative on Monday. Ludwik Kotecki said that v You can’t rule out even double-digit interest rates in Poland.

Events in the United States are also a problem for the zloty, where May CPI inflation broke all economists’ expectations. This has led to speculation that the Fed will even opt for a 75 point rate hike. Such a move by the Federal Reserve would require an appropriate response from the Polish Monetary Policy Board, which would then have to switch to hikes of up to 100 points (or even higher).

As a result, in the global currency market, we observe a significant increase in the value of the dollar against the euro. The EUR/USD exchange rate fell Monday morning to 1.04721 and approached the long-term low a month ago. The result of this in the Polish market dollar It rose by 3.5 pounds, and its price was 4.4159 PLN.

Swiss franc exchange rate

It grew by more than two, rising to an amount of 4.4572 PLN. British pound

It cost 5.4092 PLN and was almost twice more than before the weekend.

The aversion to Polish assets is also evident in the capital market. The yield on Polish 10-year bonds rose by as much as 20 basis points, reaching the level of 7.36%. The last time these securities offered such a high profitability was in November 2008, during the most severe phase of the global currency crisis. A higher yield indicates a fall in the bond market price. The Warsaw Stock Exchange was also below the line. WIG20 started Monday’s session with a loss of over 1.5%.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.