Thermal refresh relief In 2024, it will be intended for taxpayers who settle on a tax scale and flat tax and for those who pay a lump sum on registered income. They can exercise this right Owners only Or partners in ownership of a particular property. In addition, the work must be completed within this period Three consecutive yearscalculated from the end of the tax year in which the first expense was incurred.

What can be deducted as thermal retrofit relief? Firstly, these are building materials used for insulation or used to protect against moisture. Relief can also include a heating unit with a temperature programmer, but Thermal retrofit mitigation also includes::

- Gas or oil condensing boiler with controls and fittings;

- Gas tank or oil tank.

- A boiler dedicated exclusively to burning biomass;

- Connection to the heating or gas network.

- Building materials included in the heating installation, preparation of domestic hot water or included in the electric heating system;

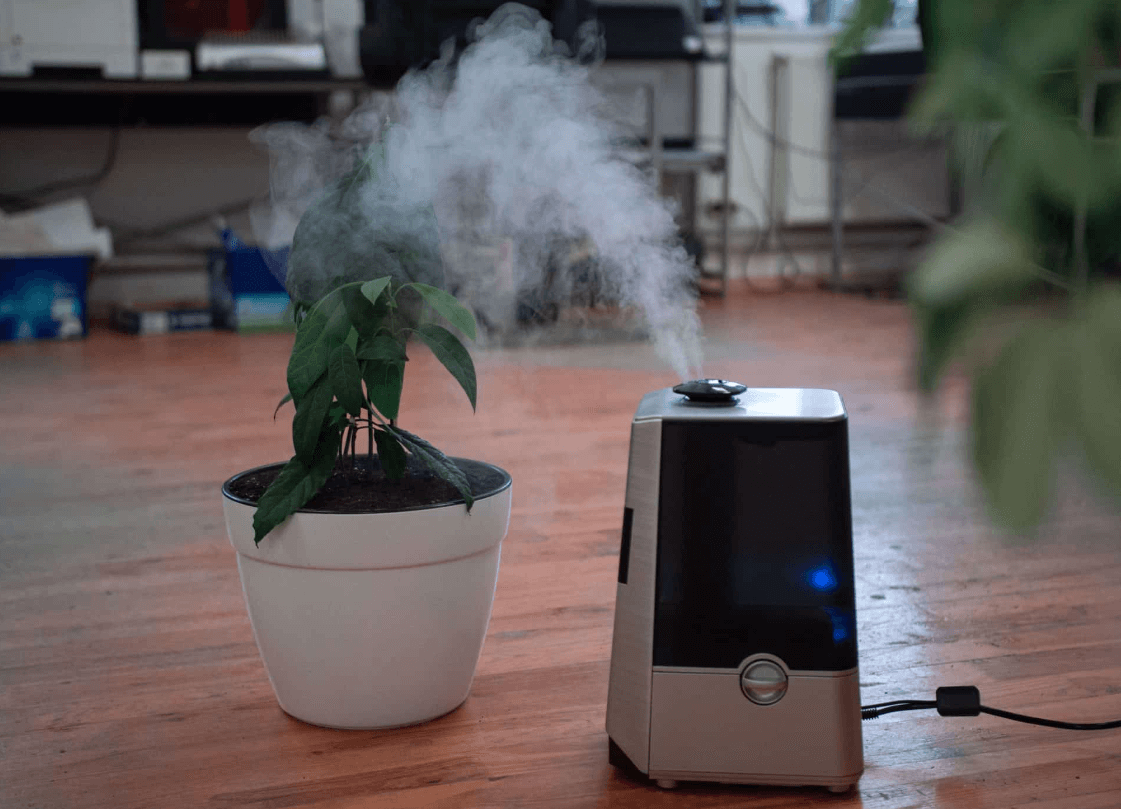

- Heat pump with accessories;

- Solar collector with accessories;

- Photocell with accessories;

- Window and door carpentry;

- Building materials that form a mechanical ventilation system with heat recovery or heat and cold recovery.

What can be deducted as thermal retrofit relief? In 2024, you can also deduct all types of projects that result in a significant reduction in heat loss in the building. So, first of all, it's deductible Conduct an energy audit of the building Before implementing a thermal retrofit project or conducting a thermal analysis of the building. These are essential from the perspective of planned investments. What else can be deducted from thermal retrofit mitigation? Investors can get the discount in 2024:

- Preparation of design documents related to thermal retrofit works;

- Conducting expertise in the field of ornithology and ornithology;

- Insulating building partitions, balcony slabs or foundations;

- Replacement of exterior woodwork (windows, skylights, balcony doors, exterior doors or garage gates);

- Replacement of existing heating installation elements;

- Installation of gas condensing boiler and condensing oil boiler;

- Installation of a heat pump, solar collector, mechanical ventilation system with heat recovery or installation of photovoltaics.

What can be deducted as thermal retrofit relief? In the long list, the legislator also stipulated the possibility of deducting the activation and regulation of the heat source Exhaust gas analysis. The package also includes hydraulic regulation and balancing of the tillage system Dismantle the solid fuel heat source.

Thermal refresh relief It is not limited to just one project. This means that an investor can make several investments and then request financial support for them through PIT. How much will thermal upgrading be mitigated in 2024? This has now been defined at the level 53 thousand zlotys. We are talking about a single taxpayer. In the case of married couples, both husband and wife can benefit from the relief separately, which actually means that thermal upgrading is possible. Maximum profit of PLN 106,000.

However, before the thermal retrofit subsidy refund can be transferred to the property owner's account, this must be done Documenting investments with invoices. The assumption here is that the amount of expenditure is the net value with goods and services tax. Importantly, the thermal retrofit subsidy will not apply when the expenditure is financed by the National Fund for Environmental Protection and Water Management or any regional funds.

Thermal refresh relief It is deducted from the tax return for the tax year in which the expenses are incurred. This can be done in PIT-36, PIT-36L, PIT-37 or PIT-28, which must be accompanied by a PIT/O attachment, i.e. information about deductions. How often can you benefit from thermal refresh relief? When you complete your PIT return, you must deduct the expenses you incurred during the thermal retrofit work from your income.

Only from this amount do we calculate the tax. If our income is less than the deductible amount, We can deduct the rest of the benefit in subsequent years. But it should be noted that this can be done by: Six more years. This time is calculated from the tax year in which the first expense was incurred.

When it comes to thermal relief, it is worth remembering that in case Settlement in relation to the spousesVAT invoices documenting expenses incurred for both spouses do not need to be issued. In this case, it does not matter to whom the invoice was issued. Recipients of a grant from the program Clean air, can also benefit from thermal refresh relief. You can deduct your own contribution to make the investment, but you cannot deduct state-financed expenses under this program.

Read also:

Photovoltaics Financing 2024. Where to get money to buy panels?

“Clean air” is facing radical changes. The Climate Minister speaks clearly

They have heat pumps installed and are receiving terrible bills. We know where they come from

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.