It may come as a surprise to borrowers in their families and relatives to pay tax on the loan in some situations. If they do not, the tax office will first collect the tax itself, and then impose a fine of up to 20% of the amount borrowed! And then the borrower will have a debt not only to the family, but also to the tax authority. So how to borrow in the family so that there are no problems with the tax office and even the record? So what should we do to safely borrow money from relatives and relatives?

Contents

While getting a loan from a family member is quite simple in itself, it undoubtedly requires knowledge. Of course, it is known that not everyone is able to constantly follow changes in regulations, but before borrowing money, it is worth getting acquainted with their current version for your financial security.

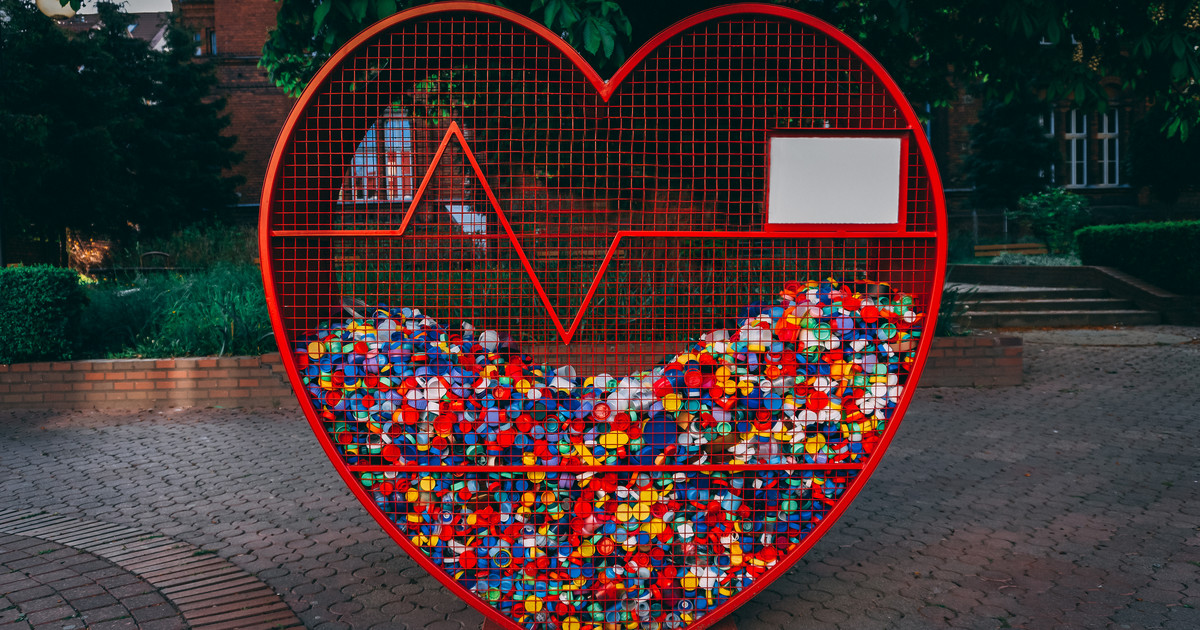

A family loan is being treated as a great alternative to bank loans or loans in branch banks, not just because it is usually “cheaper”. It can also be faster (family doesn’t analyze our creditworthiness like banks), and in addition, we can often count on flexibility in terms and repayment dates.

These facilities may be especially important for people who “really” need cash or who are in such a poor financial position that they do not have an opportunity to obtain an “official” loan. Financial help from the family can be invaluable.

However, we cannot forget that the loan remains a loan and the one who granted it has the right to demand its refund. Constant extension of the repayment date or non-fulfillment of promises carries with it the risk that both parties will pay for this loan with great stress, loss of mutual trust, which is then difficult to rebuild.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.