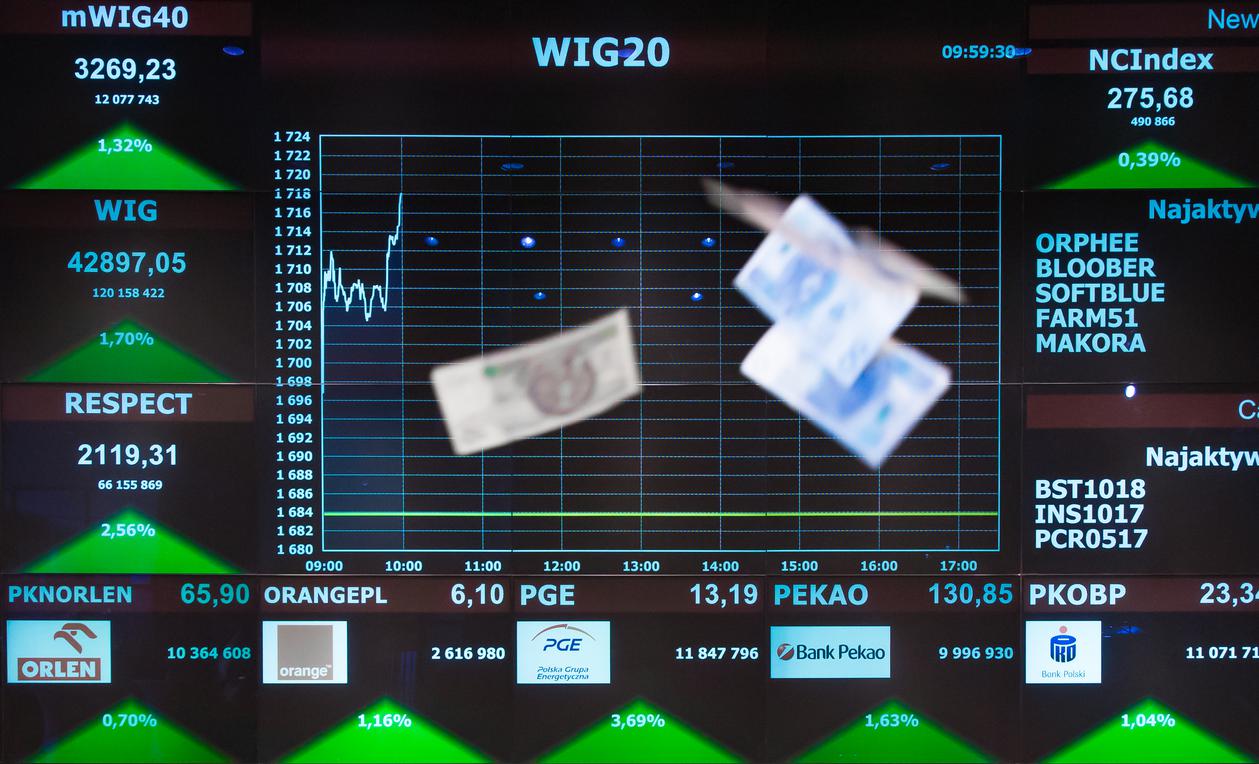

The value of the portfolio of 15 companies selected by a team of analysts led by Marcin Materna rose by 57.5 percent over the 12-month period. This result is twice the growth of wigs in the same period.

As the portfolio authors emphasize, the surplus relative to borrowed profit increased gradually throughout most of the year and was not due to isolated events. However, four companies turned out to be laggards – recording a lower rate of return than WIG, and two of them – 11 Bit Studios and CD Projekt – made a loss. These securities, such as those of Answear, AB, Budimex and Ciech, are no longer in the proposed 2024 portfolio. However, the following appeared in it: BNP Paribas, Pekao, Dom Development, Asbis, Grupa Azoty, Toya, Rainbow, LPP, VRG, and the following companies did not lose their status as favorites: PKO BP, Alior Bank, Synektik, Mostostal Zabrze. Croc, Intercars, Orlin, PZU and Benefits Systems.

At a high level

Bank stocks occupy more than a fifth of the proposed portfolio, because continued expected inflation above the national central bank's target in 2024 and limited prospects for significant changes in interest rates would lead to a small but still increase in interest income for banks. Their shares are trading at relatively low premiums, and high dividends are on the horizon – close to 10%. (Including Pekao and PKO BP, analysts do not rule out Alior's first-ever stock dividend). The write-off line should be supported by consumer financial stimulus. Analysts draw attention to the legal risks associated with the consumer loan portfolio – compensation companies are slowly starting operations that may lead to the need to create reserves in banks.

Analysts have a positive view of PZU, which is helped by the improved profitability of the banks in the portfolio (Alior, Picao). In contrast to this industry, there are no significant regulatory or systemic risks, and the prospect of dividends increases its attractiveness to investors. If interest rates start to fall, according to specialists at BM Millennium, insurance company stocks should perform better than bank stocks.

Commander Khalaf

From the construction industry, which, along with the banking and clothing sectors, topped the podium in rates of return in 2023, Mostostal Zabrze remained in the BM Millennium portfolio because, after a significant price increase, experts considered Budimex's valuation to be overvalued. The situation is different with Mostostal Zabrze, which, according to analysts, is undervalued (the target price set by Millennium is PLN 5.80, i.e. 37% more than the price on the Warsaw Stock Exchange). According to experts, the company has many advantages.

“First of all, in industrial and general construction work, Mostostal Zabrze largely uses subcontractors. This means that a low level of revenue does not necessarily mean unused capacity and related costs. Secondly, the amount of profits is determined not only by the amount of revenue, but also amount of margin, which is especially important in construction and engineering works, good contract management and, as a result, reduction of unplanned costs. In this regard, Mostostal Zabrze declares its focus on cooperation with reliable and reputable contractors and on specialized work in which Ensuring the success of the investment is more important for the client than the price. As a result, the company declares that it will maintain profitability even with a decline in sales volumes,” the justification read, adding that the release of EU funds after the elections should dispel concerns about the volume of contracts that could be obtained. on it in this field. From general construction.

The change in the housing loan support program after the election should be beneficial for Dom Development, BM Millennium analysts believe. Although there is no final form for the Mieszkanie na start programme, the proposal submitted for consultation indicates that subsidies could also be granted for larger loans. Another advantage of developer assets is the regularity and amount of dividends paid.

It is time for a breakthrough

Dividends are also a plus for Orlen stock, but even last year's high rate hasn't led to a significant price increase. However, the specialists at BM Millennium think so It's not even perfect, but significantly depoliticizing the way a company is run should remove most of the discount from the valuation and unleash the company's value potential.

“We see risks associated with the government’s proposals for a tax on extraordinary profits, but we believe that even if implemented, such moves are already discounted in the share price,” the analysts add.

They are also betting on another company that has ownership of the state treasury – Grupa Azoty. Such a shareholder means that even despite a series of losses, the bankruptcy of the company is unlikely. The results were supported by lower gas prices and the first signs of a recovery in farmer demand. Analysts believe that an increase in grain prices is still needed to fully return to normal.

They add: “Since the company is not going bankrupt and the first signs of improvement are already beginning to appear, buying its shares may achieve an above-average rate of return.”

Powerful with consumer power

A large group of proposed companies are those that benefit from the increasing wealth of consumer portfolios: LPP, VRG, Rainbow, Benefit and Asbis.

“As a result of lower inflation and a large nominal increase in earnings, real wages will rise again from mid-2023. This year, we will see another large increase in incomes driven by a 20% increase in the minimum wage, the announced 30% increase in teacher wages, and a With a 20% increase in public sector wages and the 500+ to 800+ interest index, at the same time we expect inflation to be at a lower level than last year. Analysts expect that this year we will also return to clearly positive economic growth, and unemployment may decrease slightly.

In their opinion, along with improved consumer confidence, all this indicates an improved position for businesses in almost all market sectors.

In addition, LPP and VRG are supported by a strong zloty, and analysts see the opportunity for Asbis to enter new areas of activity (robotic solutions, equipment renewal), expand the distribution network (for example, entering the TK Maxx network) and close cooperation with Apple.

“We expect further development of the company's sales, although gross sales margins are likely to be slightly lower than in the past 12 months,” the analysts add.

Good trend

In the case of Synektik, experts are pinning their hopes on the money hospitals should receive from the KPO. This would provide an incentive to purchase equipment (the listed company is a distributor of innovative medical devices and a manufacturer of advanced radiopharmaceuticals). In the past year, robotics sales have increased dramatically, and each system sold generates recurring revenue from the sale of consumer services and gadgets in the following years.

TOYA, which imports and distributes power tools and hand tools for professionals and home use, is dynamically increasing its revenues. Analysts confirm that in the second and third quarters, the trend of operating margin decline was reversed, and that its assessment based on historical results is not exaggerated.

Sector bias

| industry | behavior |

| Bank | prevail |

| fuel | prevail |

| insurance | prevail |

| Handel | prevail |

| Developers | prevail |

| industry | prevail |

| Media | prevail |

| raw materials | neutral |

| Energy engineering | neutral |

| the games | neutral |

| building | neutral |

| chemistry | neutral |

| He. She | weight loss |

Source: BM Millennium

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![This will be the retirement age in Poland – there is a decision. There are projections for the pension index for 2024 [24.04.2023 r.]](https://d-art.ppstatic.pl/kadry/k/r/1/03/99/644011c6ba5d7_o_original.jpg)