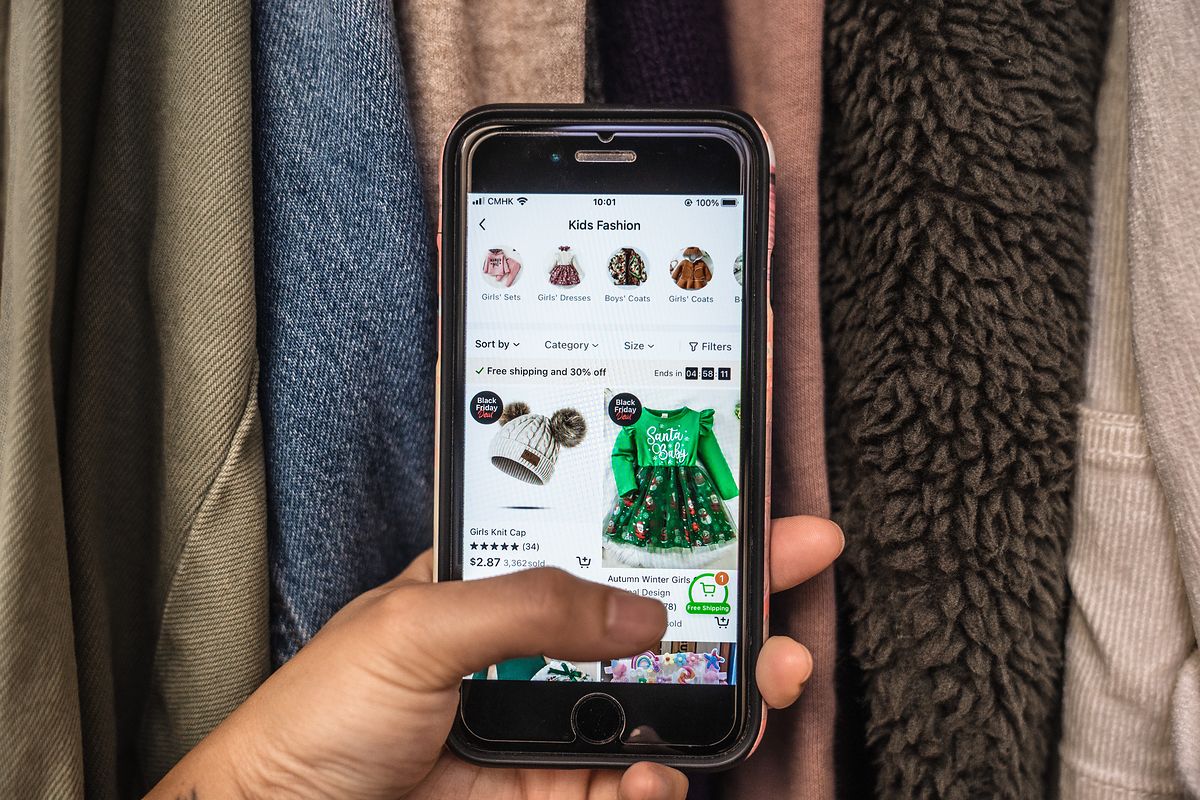

Poles love ‘buy now pay later’

From the latest report by the Financial Markets Development Foundation (FRRF) and credit information provider CRIF, we learn that In September this year, the Poles deferred payment for purchases with a total value of PLN 193.1 million.. This amounted to 185.4 percent. over a year ago and 14.6 percent. more than a month ago.

The rest of the article is under the video

See also: “The Monetary Policy Committee is in a difficult situation.” An economist says what’s next for interest rates

During the month we have postponed 640 thousand. Payments – results of the analysis. This means an increase of 231.3%. Compared to the same period of the previous year, by 8.6 percent. compared to the previous month. In September, the deal averaged 302 PLN and, interestingly, was 13.8 percent higher. Less than last year, but 5.5 percent. higher than last month.

The snag is that The above data shows only a part of the Polish market in deferred payments. The biggest players – primarily licensed loan companies, but also banks – report transactions to several credit databases. However, they do so in a very organic and eclectic way. For example, they provide information only about the first transaction made by the customer.

We understand that not all entities report deferred payment transactions. This causes the market picture to be incomplete– confirms Agnieszka Wachnicka, President of the FRRF, in an interview with money.pl.

Deferred payments have their own rules

Our interlocutor’s loose estimates show this Youth market for deferred paymentsOnly a few years in terms of the annual amount of funded purchases It may be worth several billion zlotys today .

In my opinion, the value of the deferred payments market and its growth dynamics are much greater than the numbers indicate – the head of the FRRF believes.

Comparing the classic non-bank loan market – including the so-called payday loans (usually granted for a month) and installment loans (from several months to several months) – amounted to 6-8 billion PLN. In contrast, lending activity to financial institutions in 2021 totaled PLN 187.6 billion and was 33 percent higher. compared to 2020 Currently, the credit and loan market is declining.

Lenders operate under the Consumer Credit Act system. However, the door was left open for postpaid service providers.

Suppliers They are exempt from the obligation to comply with the provisions of the Consumer Credit Act when the loan is free.Let us remind you that the idea behind this solution is – at no cost to the consumer – to defer payment for 30 days (then the shop will usually pay the commission back to the company – arguably a form of reward for getting a customer – editor’s note). Interest is charged only when the customer fails to meet the final payment deadline or when he spreads the liability over several instalments – explains Agnieszka Wachnicka.

Even though the payment deadline has been passed and the payments are distributed in installments, it is still possible to circumvent the Consumer Credit Act. As explained by our interlocutor, it is sufficient to sell these receivables to another company.

The art of avoiding coral reefs

It doesn’t end there. This is being said behind the scenes Companies providing BNPL services may deliberately avoid reporting transactions to credit databases so as not to scare off the customer. The point is, some people use “BIK ALERTS” – a commercial service that is supposed to protect us from credit or loan extortion for our data. It consists in sending an email or SMS notification about the liability incurred at a particular moment.

If the customer has deferred payment and uses the above alerts, he must also receive this notification . However, because of the method of communication, which is supposed to make us think of deferment as a payment solution, not everyone realizes that it is actually a loan. He finds out when he gets an alert, which for some is disgusting.

Not reporting to credit databases has more downsides. As the FRRF president points out, when a buyer puts off shopping at several stores through several different companies, they can treat themselves to a relatively high payment obligation in a short time.

If he goes to a bank or loan company for money, he may get it, though he shouldn’t, because the financing institution won’t know the debts of the companies that offer deferred payments. What threatens her?

Uncontrolled and not fully considered indebtedness can lead to difficulties in repayment, and in the worst case – a debt spiral – Wachnicka responds.

Deferred payments and inflation

Deferred payments are the foundation of the depreciation mill. In the festive period, they can reach a 40% share of the store’s turnover.

Deferred payments increase the appetite for shopping. The variety of business models of the companies that offer them and the variety of information standards makes it difficult The consumer can get lost in liabilities. In other words, he can go into debt with five companies at the same time and, in a relatively short time, have to repay an amount that exceeds his disposable income or simply forget about it, warns the expert.

Basically, we must reduce consumption to contain inflation. It seems to me, however, that it cannot be said unequivocally that the development of deferred payments hinders the fight against price hikes – assesses Wachnicka.

BNPL to amend

Eldorado may end in a while, because EU lawmakers have taken deferred payments into the crosshairs.However, it will be some time before they sort out this market.

Member states, including Poland, will have to adapt their national regulations to EU requirements by the end of 2024.

Karolina Wisota, money.pl journalist

If you want to keep up to date with the latest economic and business events, use the Click-through Chatbot here.

Rate our article quality:

Your feedback helps us create better content.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.