China’s trade surplus exceeded $100 billion in one month for the first time in history. This is worse news than you might think.

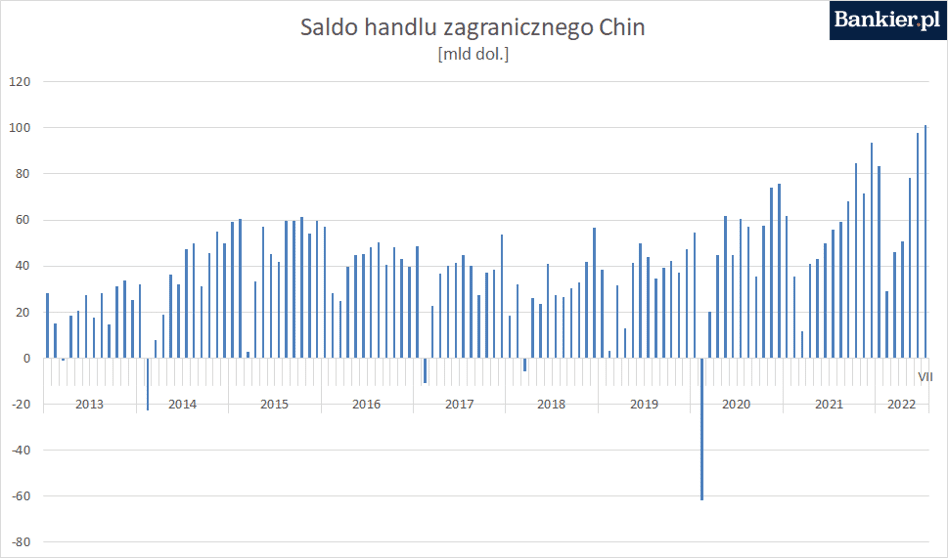

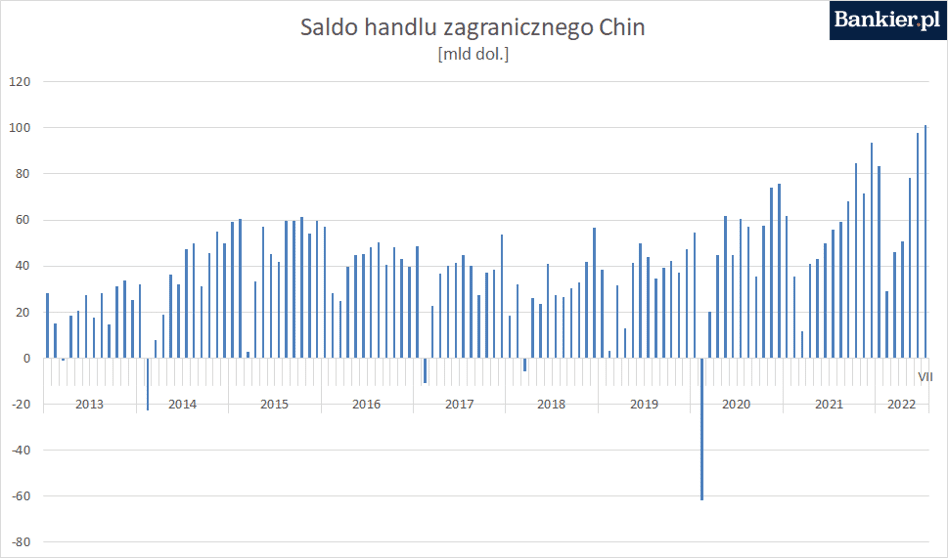

In July, goods worth approximately $333 billion were exported from the Middle Kingdom, and nearly $232 billion of products were imported outside the Wall. As a result, China posted a record trade surplus that customs officials estimated at $101,270,000,000 or $101.27 billion.

Sales abroad were the second highest (after December) in history. Meanwhile, the largest value of foreign purchases has already been recorded four times. Compared with the same period last year, exports increased by 18 percent, while imports – by 2.3 percent. This year, the dynamics of imports was higher than exports only once.

Analysts have been looking for signs of weak exports for months, pointing to, among other things, the People’s Republic of China’s zero-Covid policy, disruption to global supply chains, declining demand for goods abroad as warehouses become more filling, or other societies’ overburdened capacity for Chinese surpluses. This is not visible in international trade data, although it is suggested, for example, by PMI readings.

While exports remain strong, imports are hitting weakly. A slight increase in the nominal value of foreign purchases means that in real terms – under conditions of rapid price growth – fewer goods from abroad go to the Middle Kingdom. This may prove the strength of the Chinese economy. But this is a misunderstanding. The Chinese did not suddenly discover a magical way to replace foreign raw materials, nor did they find that they were tired of Hermes belts or Gucci bags. If they bring in a few of them, it means that the demand behind the wall – investment and consumption – is missing.

It was hard to be otherwise The huge uncertainty related to the Covid zero policy, the structural problems of the economy and the attitude of the Beijing authorities towards the prominent representatives of the private sector. Businesses are afraid to invest and hire new employees, and the population is afraid to spend. Fasten your belts wisely and wait for the difficult period.

From a macroeconomic perspective, the excess of exports over imports (external imbalance) corresponds to the excess of the saving rate over the investment rate (external imbalance).

In the case of China, the saturation of investment is already very high, while the rate of saving, the unconsumed part of the income, remains huge. This is the result of a great willingness to set aside money for the future in the face of a lack of social safety nets, but also – According to some experts, first of all Economic policies that distort income distribution. Hundreds of millions of Chinese are not paid enough for their hard work, nor are they guaranteed social benefits (education, health, retirement) at a decent level. Meanwhile, Beijing regularly supports companies with subsidies and cheap loans, which subsidize production, which “must” travel abroad because there is no demand for them in the country.

Maciej Kalwasiński

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.