This time, the FOMC decided to raise interest rates by 50 basis points. This pushed the federal funds rate to its highest level since December 2007.

The Fed funds rate range remains today It rose by 50 basis points to 4.25-4.50%.

The Federal Open Market Committee (FOMC) announced in a statement. The December decision was taken unanimously and matched market and economist expectations.

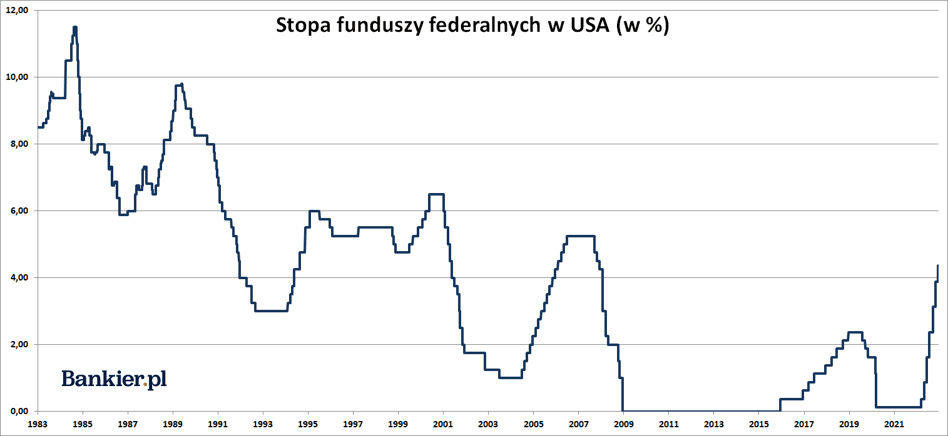

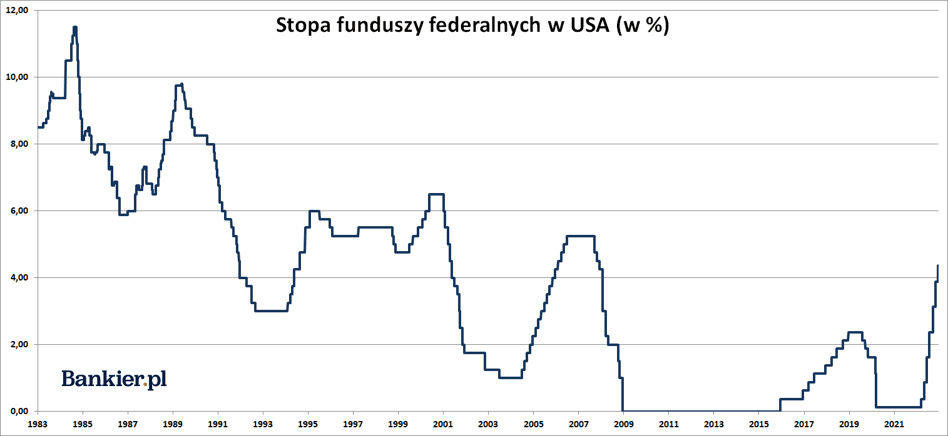

This is the first rise of 50 points since May. in the previous four meetings The Federal Open Market Committee raised the federal funds rate by 75 basis points. In all, since March, the federal funds rate has been raised by 425 basis points. It is the sharpest cycle of increases since 1981.

In the previous two cycles of monetary tightening (in 2004-06 and 2015-18), interest rates were raised by only 25 basis points. Already after the September increase, the fed funds rate range has already exceeded the maximum for the 2015-18 cycle. Then it took the Fed two years to go from zero to just 2.25-2.50%. Now, in just 9 months, US interest rates have reached levels last seen in December 2007.

– The committee decided to raise the federal funds rate to 4.25-4.50% i You would expect additional increases to be appropriatee In order to achieve such a state of monetary policy that would be sufficiently restrictive to Bring inflation back to the 2% target. – We read in the December Federal Open Market Committee statement. – The Committee is firmly intent on bringing inflation back to the target of 2 per cent – added.

The Fed’s leadership was forced to rapidly normalize monetary policy through a wave of price inflation not seen in four decades. In June, US CPI inflation was 9.1%. It was the highest since 1981. November data showed a slowdown in annual CPI growth to 7.1%. — which is still 3.5 times higher than the federal inflation target of 2%. Core inflation in the consumer price index has also fallen from its highest level in more than 40 years.

Determine the pace of future increases in the federal funds rate The committee will take into account the cumulative tightening of monetary policy and the delayed transmission of monetary policy to economic activity. Inflation, economic and financial developments – repeat a phrase that was first included in the November FOMC statement.

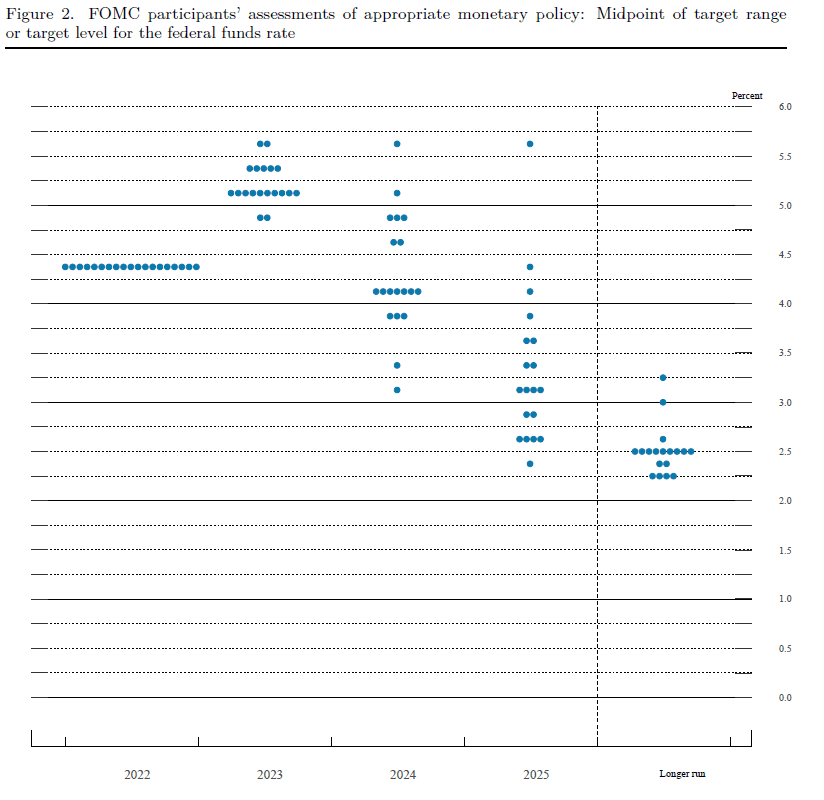

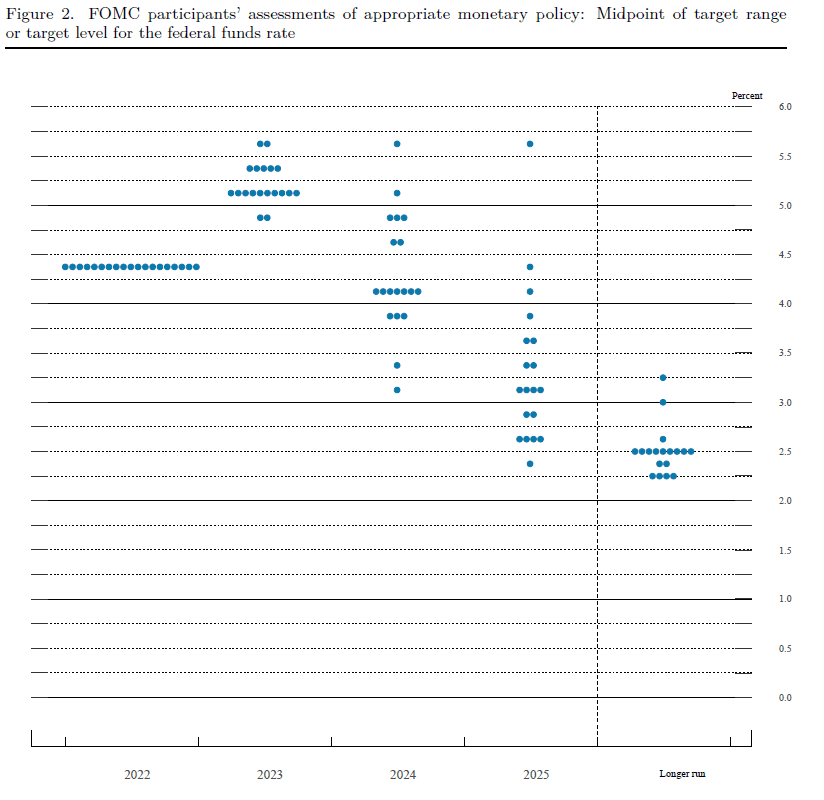

Despite this, the federal funds rate, which a majority of committee members would have desired at the end of 2023, increased compared to September. If in September “Fedodots” averaged at the level of 4.6%, in December it was already 5.1%. This means that a majority of next year’s FOMC members will be willing to vote on a total hike of 75 basis points. – for the range of 5.00-5.25%. That’s about 25 basis points. More than expected futures market before the release of the December statement. The first (and somewhat insignificant) cut in the federal funds rate will only be possible in 2024.

Other macroeconomic forecasts of the committee members changed less significantly. Average expected PCE inflation for the end of next year was raised to 3.1% from 2.8% in September. Throughout the forecast period (i.e. until the end of 2025), the majority of the FOMC members expect this indicator to remain above the 2% target..

The median forecast for the unemployment rate for next year also increased slightly (from 4.4% to 4.6%). On the other hand, the GDP growth forecast for 2023 has decreased: from 1.2% to 0.5%. Increasing inflation and interest rate expectations while lowering economic growth expectations is likely to be bad news for stock markets.

Powell is still a hawk

– I would like to emphasize that we understand the difficulties that Americans face due to high inflation and that We are very determined to bring inflation down to the 2% target – This is how Federal Reserve Chairman Jerome Powell began his press conference.

We still expect the upcoming hikes to be appropriate to adjust monetary policy enough to bring inflation down to 2%. (…) Restoring price stability will likely require maintaining a restrictive monetary policy stance for some time Powell added. “We will continue the course until we do our job,” the Fed chairman said.

Powell’s unequivocally hawkish rhetoric did not sit well with Wall Street investors. By 20:42, the S&P500 was down nearly 1%, dropping below 4,000 points. The Nasdaq lost more than 1.3%. On the other hand, the 10-year US government bond yield rose to 3.53%. The dollar rose slightly against the euro, recouping losses from the beginning of the day.

The Fed Chairman noted that prices for services continued to rise rapidly, with the exception of housing services. In his view, it is a function of a very strong job market. That is, places where economic downturns have not been observed: employment growth remains strong, the number of jobs remains high, and the imbalance between demand and supply persists. It was a fairly straightforward suggestion that the Fed would like higher unemployment and a weaker labor market to quash the demand side of inflationary pressures.

–

We assessed that our policy is not restrictive enough, even after today’s action. We’ve given our individual assessments of what needs to be done to change this – Jerome Powell responded to a reporter’s question.

– This is not the time to cut interest rates. We believe that we will have to maintain the restrictive monetary policy bias for some time. Historical experience strongly cautions against premature easing of monetary policy. “I wouldn’t say we’re considering a rate cut,” Powell said when asked about market expectations for a federal funds rate cut in late 2023.

This was the last FOMC meeting scheduled for 2022. The next dates are set for January 31st and February 1st.

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![Shopping Alert! Biedronka, Lidl, and others removed these goods from shelves following GIS decisions in 2023 [23.01.2023]](https://d-art.ppstatic.pl/kadry/k/r/1/ca/70/63cc360988985_o_original.jpg)