2022-09-23 22:05

Publishing

2022-09-23 22:05

Wall Street investors seem to have finally realized that the Fed wants to create a recession in order to bring down inflation. So far the market has priced “soft landing”. Now he began to doubt them.

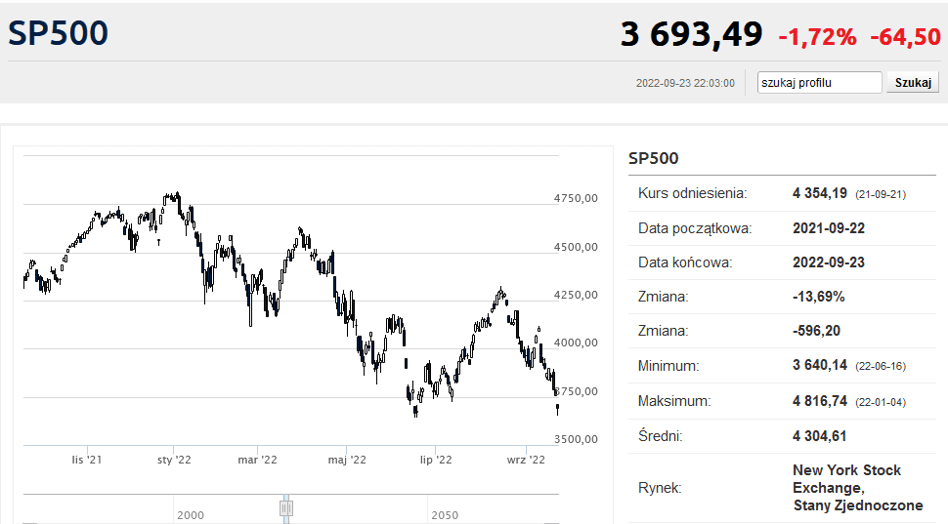

The Dow Jones fell 1.61% on Friday and ended the session below 30,000 points and the lowest since December 2020. The S&P500, after dropping 1.72%, was just above the June bear market. Similar to the Nasdaq Composite Index, which lost 1.80% and stopped at 10,687.93 points. The balance of Friday’s session managed to improve in the last minutes of trading, thanks to which the S&P500 did not reach its lowest closing price this year.

Analysts have no doubt as to the reason behind such a massive sell-off in US stocks this week. This is a reaction to the decisions taken by the Federal Reserve authorities. The US central bank plans to raise interest rates close to 4.6%. This would be the highest level since 2007 and could risk a sharp recession in the debt-laden US economy. This, in turn, means much lower profits for listed companies in 2023. This scenario is now discounting the stock market.

– This is something we are not used to and that is why it is so surprising to most of us. It will be a long battle between the Federal Reserve and the markets, and between them an economy that has yet to respond to monetary tightening, George Goncalves, head of macroeconomic strategies at MUFG, told Reuters. Over the past 35 years, Wall Street has been in the habit of cutting interest rates from the Federal Reserve in response to any downturn in the stock market. Now the opposite is true: the Fed raises interest rates and does not look at falling stock indices.

– The deterioration in corporate earnings has not been priced in the stock markets, and we expect corporate earnings to surprise this quarter negatively, with more warnings about earnings as companies that have managed to deal with the situation so far will have to warn of deteriorating profit margins in the future, said Ricardo Gil , head of asset allocation at Trea Asset Management.

Are retail bonds safe? Do they protect against inflation? We answer the 50 most common and important questions about the Treasury’s proposal for savers. Download the e-book for free or buy it for 20 PLN.

do you have a question? Write to [email protected]

The highest interest rates since the fall of 2007 are a reality in the debt market, where the yield on US two-year bonds has risen to 4.26%. For comparison, a year ago the ratio was only 0.25%. So we have a 400 basis point increase. Within 12 months. This is a powerful step. The 10-year Treasury yield is also the highest since 2010, paying more than 3.8% on Friday.

The rapid rise in market interest rates in America is causing panic in other parts of the world. Japan is trying to struggle to raise the value of the yen, which has lost nearly 20% against the dollar this year alone. The British pound is the weakest since 1985 (it has also surrendered about 20% since January), and the euro is trading at a 20-year low. In Europe, there was a massive sell-off in stocks, with the major indexes losing from nearly 2% to more than 3%. European government bond yields also rose sharply.

Recession signals were also sent by the commodity market. West Texas Intermediate Crude at a discount of 5.4% and was trading below $80 a barrel for the first time since January. Prices of industrial metals and many agricultural products fell by 3-4%. Under very strong dollar pressure forward gold price It fell 1.6% to its lowest level since March 20 and the same Confirmation of the recent collapse of the main support.

K

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.