BUSINESS INTERIA is on Facebook and you are up to date with the latest happenings

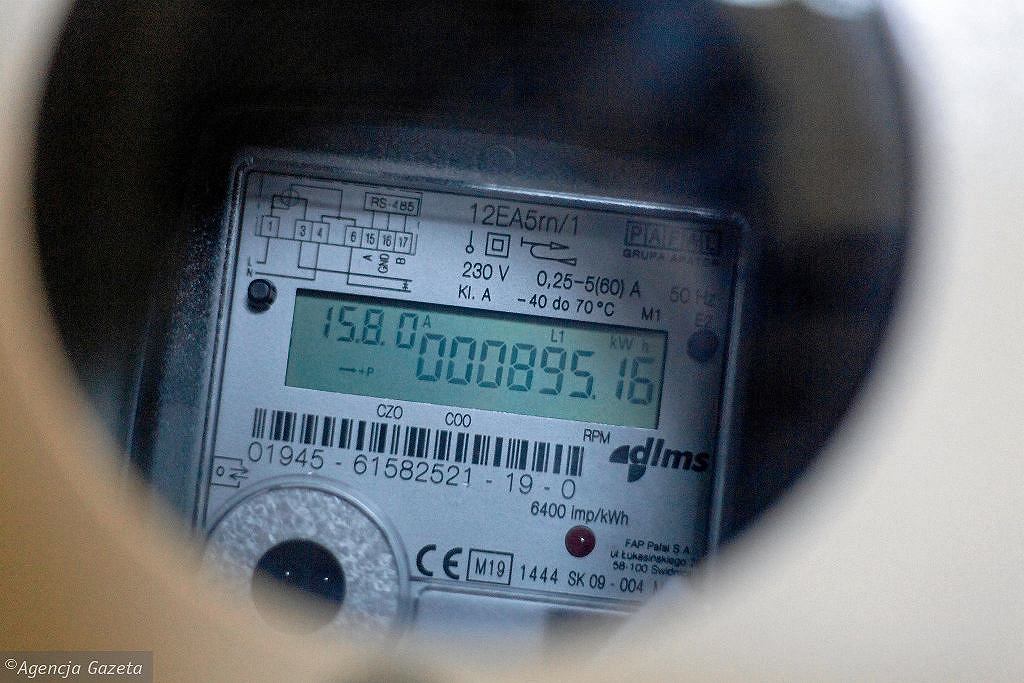

In January, the tax law of the Polish system, which was adopted at a rapid pace, entered into force. It contains 270 pages and is the largest tax amendment in 30 years, changing the provisions of as many as 26 laws. For entrepreneurs, this means big changes in tax rules: higher health insurance premiums and calculated completely differently. For each form of tax (depending on scale, flat rate, flat rate or tax card) – it will be calculated differently based on a different assessment basis.

Meanwhile, there is still no state information center to explain the changes introduced by the Polish tax order, or the announced hotline. The ZUS has recently published a table with a new basis for calculating individual groups, and now it has announced the launch of a special calculator.

– We are aware that there may be some uncertainties, especially in the initial period of application of the new rules. That is why ZUS is taking a proven initiative and providing a calculator – says the professor. Gertruda Josinska, President of the Social Insurance Institute.

He also adds, this tool will make it easier to determine the basis of the health insurance premium and to calculate the amount of the premium due.

– Having entered the necessary data, such as the tax period, tax form, amount of income or income, the calculator will help determine the basis of assessment and calculate the amount of the installment due for a given month – explains President Uscińska.

The calculator will be available on the website www.zus.pl. Eventually, it will also be available in the Płatnik and ePłatnik programs.

ZUS emphasizes that the payer must pay all outstanding contributions that he is obligated to pay (ie for all insurances and funds, not just for the health insurance itself), with one transfer to the individual NRS account number assigned to him.

Payments to the account are settled on the basis of billing documents submitted for a given month, provided, however, that there are no arrears for previous periods. In this case, in the first place, the previous payments from the installment will be settled, and the difference in subscriptions for the current month will have to be paid. This should be taken into account if you plan to pay the contributions due for December of this year in December.

As Interia wrote, paying ZUS contributions for December of this year (although they can be paid in January) gives you the option to deduct them from taxes, allowing you to save approximately PLN 330.

Monica Krzyniak Sajevic

Echo Richards embodies a personality that is a delightful contradiction: a humble musicaholic who never brags about her expansive knowledge of both classic and contemporary tunes. Infuriatingly modest, one would never know from a mere conversation how deeply entrenched she is in the world of music. This passion seamlessly translates into her problem-solving skills, with Echo often drawing inspiration from melodies and rhythms. A voracious reader, she dives deep into literature, using stories to influence her own hardcore writing. Her spirited advocacy for alcohol isn’t about mere indulgence, but about celebrating life’s poignant moments.

![[À VOIR] Famous French musician becomes first passenger in flying car: “an incredible experience”](https://m1.quebecormedia.com/emp/emp/VoitureVol32d406fef-469b-44d8-912a-380ea2658c31_ORIGINAL.jpg?impolicy=crop-resize&x=0&y=0&w=1093&h=616&width=1200)